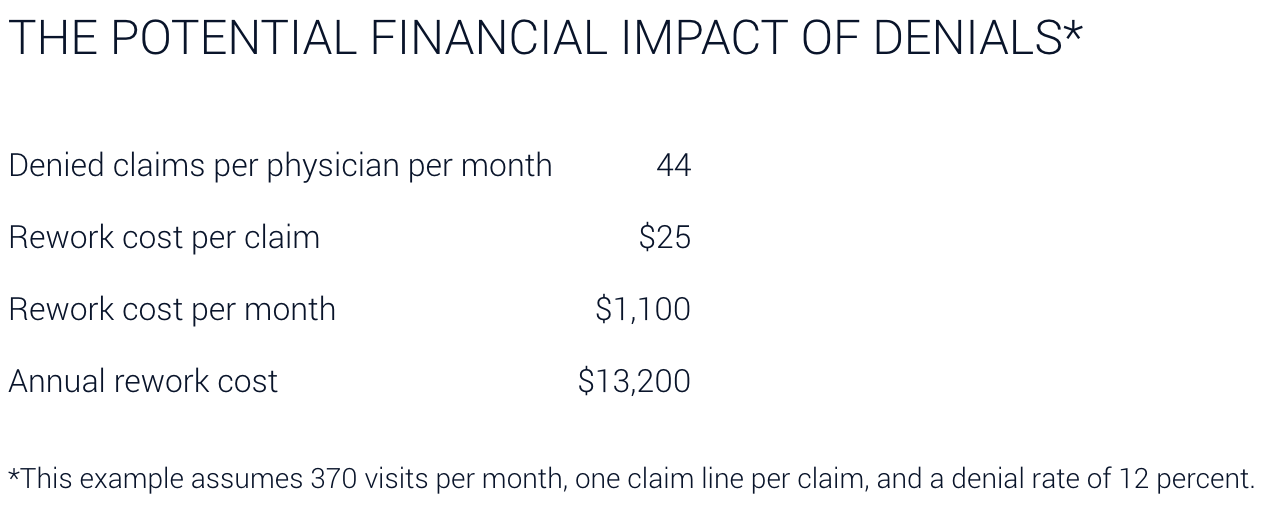

In the world of healthcare administration, dealing with medical billing isn’t just about paperwork – it’s a complex challenge. Denied claims pose a significant threat to the financial health of medical practices. Failing to handle claims efficiently can seriously hurt a medical practice’s finances and overall success. That’s why it’s super important for everyone in the practice to work together to avoid claim denials. According to the latest report from the American Medical Association, big insurance companies often reject almost 29 percent of claims without paying, mostly because the patient owes money, but also because of claim edits (about 7 percent) or other denials (around 5 percent). Fixing and resubmitting denied claims costs the practice around $25, and surprisingly, more than half of the time, denied claims are never fixed.

This article is your guide to understanding the hurdles faced by healthcare providers in the billing process. We’ll explore the reasons behind denied medical claims, the crucial appeal process, and why these aspects are vital in the healthcare revenue cycle. Going beyond the administrative side, we’ll highlight how denied claims can directly impact the financial health of medical practices. Get ready to gain insights and practical tips on how to effectively manage denials and appeals in medical billing. It’s time to simplify the complexities and empower your approach in navigating this critical aspect of healthcare.

Medical billing denials can be a formidable challenge for healthcare providers, impacting both operational efficiency and financial stability. One prevalent reason behind these denials is coding errors. Inaccurate or incomplete medical codes can lead to claim rejections, emphasizing the critical need for precise coding practices. By delving into the intricacies of coding errors, healthcare professionals can proactively address this common stumbling block, ultimately improving the acceptance rate of their claims.

Documentation deficiencies stand as another key factor contributing to medical billing denials. The completeness and accuracy of medical records play a pivotal role in claim approval. Inadequate documentation not only hinders the initial claim submission but can also pose challenges during the appeals process. By emphasizing the importance of comprehensive medical documentation, providers can reduce the likelihood of denials and streamline the reimbursement process.

Insurance-related issues form the third pillar in understanding common denial reasons. Whether it’s navigating through denied insurance claims or comprehending the appeal process, healthcare providers often grapple with intricacies tied to insurance coverage. Addressing insurance-related challenges involves a multifaceted approach, including staying abreast of policy changes, ensuring clear communication with payers, and employing effective denial management strategies. By exploring and addressing these common reasons for medical billing denials, healthcare professionals can enhance their revenue cycle management and fortify their financial health.

In the intricate realm of medical billing, adopting proactive denial prevention strategies is paramount for healthcare providers seeking financial stability. To fortify against medical billing denials, implement these key strategies to strengthen your defense against medical billing denials:

Navigating the appeals process for denied medical claims can be a daunting task, but a structured approach can streamline the process and increase the likelihood of success. Develop a structured approach to navigating the appeals process, ensuring timely and well-documented appeals for denied claims.

Here is a step-by-step guide for healthcare practices to follow:

1. Understand the Reason for Denial:

The first step in the process is understanding why the claim was denied1. This information will be available in the Explanation of Benefits (EOB) or Remittance Advice (RA) that accompanies the denied claim.

2. Review the Claim:

Scrutinize the denied claim for any errors or omissions1. This could include incorrect patient information, wrong procedure codes, or missing supporting documentation.

3. Gather Necessary Documentation:

Collect all relevant medical records, letters of medical necessity, lab results, and any other supporting documents2. These will be crucial in proving the validity of the claim.

4. Write an Appeal Letter:

Draft a formal letter explaining why you believe the claim should be paid. Include details about the patient’s condition and treatment, and reference any supporting documentation.

5. Submit the Appeal:

Send the appeal letter and all supporting documents to the insurance company. Make sure to follow the insurer’s specific appeals process, which can usually be found on their website or by contacting their customer service.

6. Follow Up:

Regularly follow up with the insurance company to check the status of your appeal.

7. Consider Outside Help:

If the appeal is denied, consider enlisting the help of a patient advocate or legal professional. They can provide further guidance and may increase the chances of a successful appeal.

Remember, time is of the essence when it comes to appeals. Insurance companies often have strict deadlines for submitting appeals, so it’s important to act quickly.

This structured approach can help healthcare practices navigate the appeals process more effectively, potentially leading to a higher rate of successful appeals and improved financial health for the practice.

Crafting persuasive appeal letters is an integral part of the medical billing process, particularly when dealing with denied claims. In crafting persuasive appeal letters, the key lies in presenting a compelling case with clarity and professionalism, tailored to the specific circumstances of the denied claim.

Here’s a step-by-step guide on how to write an effective appeal letter:

1. Start with Basic Information:

Begin your letter with essential details, including the patient’s name, insurance ID number, claim number, and date of service.

2. State the Purpose of the Letter:

Clearly state that the purpose of the letter is to appeal the denial of a specific medical claim. Mention the reason for denial as stated by the insurance provider.

3. Provide Detailed Explanation:

Offer a comprehensive explanation of why you believe the denial is incorrect. Refer to specific points in the patient’s medical records or the insurer’s policy that support your argument.

4. Reference Applicable Guidelines:

If applicable, reference any medical guidelines or research supporting the necessity of the treatment. This could include guidelines from recognized medical bodies relevant to the patient’s condition.

5. Include Supporting Documentation:

Attach all relevant medical records, letters of medical necessity, lab results, and any other supporting documents. Be sure to refer to these documents in your letter.

6. Be Professional and Polite:

Maintain a professional and polite tone throughout the letter. Avoid using confrontational or emotional language.

7. End with a Call to Action:

Conclude the letter by requesting the insurance company to review your appeal and reconsider the claim.You can also express gratitude for the payer’s attention, anticipating a fair and timely resolution.

8. Proofread:

Finally, proofread your letter for clarity, grammar, and spelling errors before sending it.

Remember, each insurance company may have specific requirements for appeals, so be sure to follow those closely. Also, keep a copy of all correspondence for your records. With a well-crafted appeal letter, you can increase your chances of overturning a denied claim and securing payment for your services.

In the ever-evolving landscape of healthcare administration, the integration of technology, specifically denial management software, has become instrumental in mitigating the challenges posed by claim denials.

Denial management software serves as a comprehensive tool designed to streamline and enhance the entire denial resolution process. This advanced technology is tailored to identify, track, and efficiently manage denied claims, offering a systematic approach to resolution.

Denial management software comes equipped with an array of features designed to optimize the claims resolution process:

Denial management software is designed to seamlessly integrate into the healthcare revenue cycle, becoming an integral component of the financial workflow. By connecting with existing systems such as electronic health records (EHR) and billing platforms, it ensures a cohesive and synchronized approach to managing denied claims. This integration facilitates a continuous feedback loop, allowing healthcare providers to address issues promptly, optimize processes, and ultimately enhance the overall financial health of the organization.

Denial management software is designed to seamlessly integrate into the healthcare revenue cycle, becoming an integral component of the financial workflow. By connecting with existing systems such as electronic health records (EHR) and billing platforms, it ensures a cohesive and synchronized approach to managing denied claims. This integration facilitates a continuous feedback loop, allowing healthcare providers to address issues promptly, optimize processes, and ultimately enhance the overall financial health of the organization.

In the world of medical billing, making sure money stays steady for the long haul is super important. Dealing with denials and appeals needs a smart and forward-thinking plan. By being careful with codes, keeping really good records, and using helpful technology like denial management software, healthcare places not only solve current money problems but also build a strong money base for the future. With these smart moves, healthcare spots are all set for a lasting and successful revenue journey.

Ready to secure your financial health? Explore innovative solutions with ZemoHealth and pave the way for enduring success.